leolasynnot90

About leolasynnot90

The Rising Reputation of Gold IRA Accounts: A Protected Haven for Retirement Savings

In an period of economic uncertainty and fluctuating monetary markets, many buyers are looking for secure and reliable avenues for his or her retirement financial savings. One option that has gained significant traction lately is the Gold Individual Retirement Account (IRA). This investment car allows people to carry bodily gold and other precious metals in their retirement accounts, providing a hedge against inflation and market volatility. As more individuals turn out to be conscious of the advantages of Gold IRAs, the demand for these accounts continues to surge.

A Gold IRA features similarly to a conventional IRA, however as a substitute of holding paper property like stocks and bonds, it allows buyers to own bodily gold, silver, platinum, and palladium. These treasured metals could be stored in a safe depository, making certain their safety and integrity. The first attraction of Gold IRAs lies of their potential to preserve wealth over time. Historically, gold has been considered as a stable retailer of value, significantly during times of economic instability. Not like fiat currencies, which might be devalued by inflation and other economic components, gold tends to retain its buying energy.

The recent economic panorama has prompted many people to reconsider their retirement strategies. With rising inflation rates and concerns in regards to the stability of the inventory market, conventional investment choices could not provide the safety that buyers desire. In distinction, gold has demonstrated its resilience throughout economic downturns, making it a lovely choice for those trying to safeguard their retirement savings. In response to a report by the World Gold Council, gold demand has increased considerably in recent years, driven by each retail and institutional traders in search of refuge from market volatility.

Establishing a Gold IRA entails a couple of key steps. First, traders should choose a custodian that makes a speciality of treasured metals IRAs. This custodian will handle the administrative elements of the account, together with compliance with IRS laws. As soon as the account is established, investors can fund it by way of a rollover from an existing retirement account or by making a direct contribution. After funding the account, investors can choose the types of precious metals they wish to carry, which might embrace bullion coins, bars, and even sure types of jewelry.

Certainly one of some great benefits of a Gold IRA is the potential for tax benefits. Like traditional IRAs, Gold IRAs can offer tax-deferred progress, which means that investors don’t pay taxes on the gains from their investments till they withdraw funds throughout retirement. If you loved this article and you would certainly like to receive even more details regarding cost-effective gold ira investment kindly check out the web site. Additionally, if traders select to transform their Gold IRA right into a Roth IRA, they can withdraw funds tax-free in retirement, provided they meet sure criteria.

Nonetheless, potential traders also needs to be aware of the risks and prices associated with Gold IRAs. Certainly one of the primary issues is the volatility of gold prices. While gold has historically been a stable funding, its worth can fluctuate considerably within the short time period. This volatility can result in potential losses for buyers who may must promote their holdings throughout a market downturn. Additionally, investing in a Gold IRA usually comes with greater charges in comparison with traditional IRAs. These fees can include setup costs, storage fees for the bodily metals, and custodial fees. Buyers ought to fastidiously consider these prices when deciding whether a Gold IRA is the best choice for his or her retirement technique.

One other necessary consideration is the regulatory setting surrounding Gold IRAs. The internal Revenue Service (IRS) has particular pointers relating to the types of precious metals that can be held in these accounts. For example, only sure bullion coins and bars that meet minimum purity requirements are eligible for inclusion in a Gold IRA. Buyers ought to be sure that they work with respected custodians who are educated about these regulations to keep away from potential pitfalls.

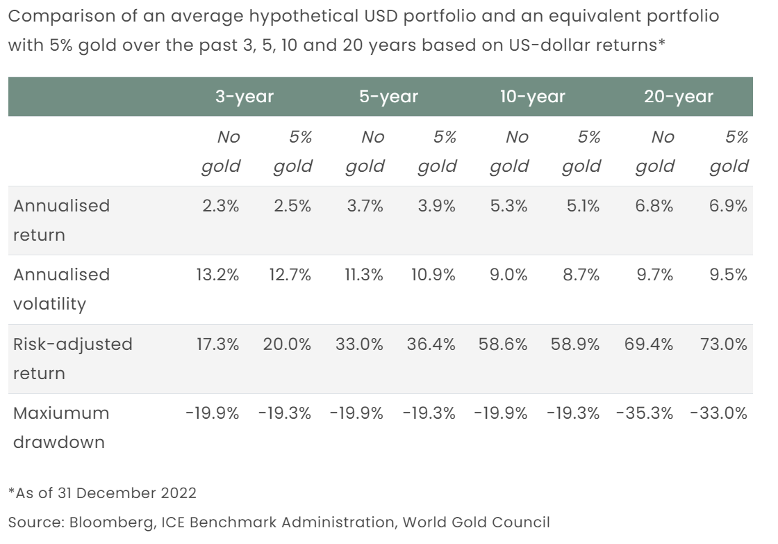

Regardless of the dangers and complexities, many financial specialists imagine that Gold IRAs can play a precious function in a diversified retirement portfolio. By allocating a portion of retirement financial savings to precious metals, buyers can potentially reduce general portfolio risk and enhance their lengthy-time period financial security. Diversification is a key precept of investing, and gold can function an efficient counterbalance to conventional asset courses like stocks and bonds.

Because the demand for Gold IRAs continues to develop, extra financial establishments are beginning to supply these accounts. Buyers now have a wider vary of options with regards to custodians and treasured metallic sellers. This elevated competitors can lead to raised providers, decrease fees, and more transparent pricing for customers. Nonetheless, it is crucial for investors to conduct thorough research and due diligence before selecting a custodian or seller to make sure they’re working with a reputable and reliable provider.

In conclusion, Gold IRA accounts have emerged as a well-liked possibility for individuals trying to guard their retirement savings from economic uncertainty. With the potential for long-time period wealth preservation, tax advantages, and diversification, these accounts provide a viable various to traditional funding automobiles. Nonetheless, prospective traders should rigorously weigh the risks and prices related to Gold IRAs and seek steerage from monetary professionals earlier than making any selections. As the monetary panorama continues to evolve, gold remains a timeless asset that may present stability and security for future generations.

No listing found.